Upcoming Events

Register today for these PSB Trust-sponsored informational events.

New Year’s Special – 6 Month CDs

Extended through February!

Contact a Team Member for more information about fees and terms.

| Interest Rate | APY* | |

| Existing Customer | 5.13% | 5.25% |

| New Customer | 5.08% | 5.20% |

Rates accurate as of 1/1/2024. Minimum balance of $500.00 required to obtain APY. Fees may reduce earnings. Penalty may be imposed for early withdrawal.

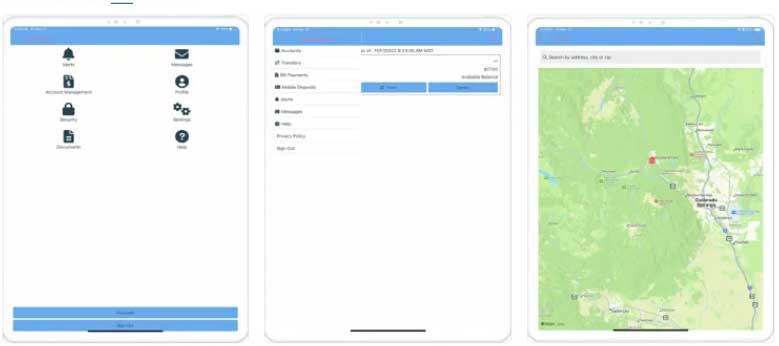

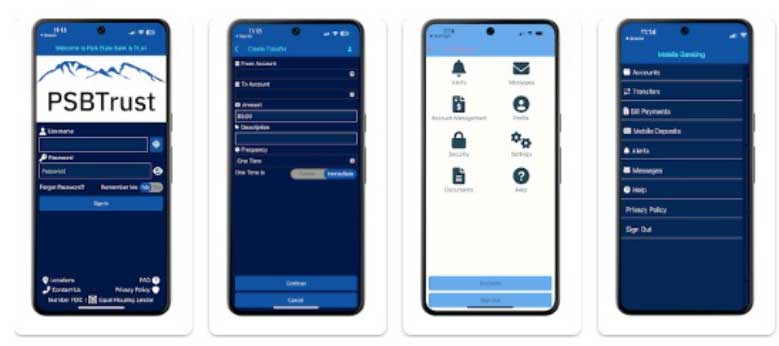

NEW! PSBTrust Mobile App

We are pleased to announce a new Online Banking Application available in the Apple App Store and Google Play Store

The new App is proving much faster, as it is integrated into our accounting system.

- Download the PSBTrust or Park State Bank App from the

Apple App Store and Google Play Store - Sign in with your existing Username and Password

- Click the “Remember Me” toggle

- Send the code to your text or email

- Enter the Code back into the App

- Hit Submit

If you have any questions, please call 719-687-9234 and ask for a Personal Banker.

Park State Bank and Trust – Woodland Park’s hometown banking partner.

We have proudly served greater Teller County and parts of El Paso & Park Counties, including Woodland Park, Florissant, Divide, Cripple Creek, Victor, Cascade, Green Mount Falls, Colorado Springs, Lake George, Guffey, Fairplay, and surrounding areas with friendly, knowledgeable, and trustworthy service for over five decades.

What makes PSB&T different?

Founded in Woodland Park, we’re an independent, locally-owned bank with a family of personal and commercial bankers motivated by your trust – not your business. Our mission is to provide the highest quality and most secure banking services for our community. At PSB&T, we believe in real personal banking. The kind of banking where we know your name and – more importantly – what you need to succeed.

We run a “no-nonsense” and “no surprises” banking system, and we’re proud to be the only true community bank in the Ute Pass Region. Whether you need personal banking, a mortgage or construction loan, commercial lending, or retail banking – you can count on receiving the most convenient and personalized service in town from every member of our banking family.

Let’s be honest – there’s no wizardry to the banking process. Thousands of institutions offer the same services. So, the value you gain is in the quality, service, and respect that we provide – and that’s where we shine at PSB&T.

Let’s get to know each other.